Tesla's Grok Gamble: Could a Car Be a Single Point of Failure?

There's something unsettling about watching Elon Musk turn vehicles into extensions of his personal tech empire. Tesla's rollout of Grok AI...

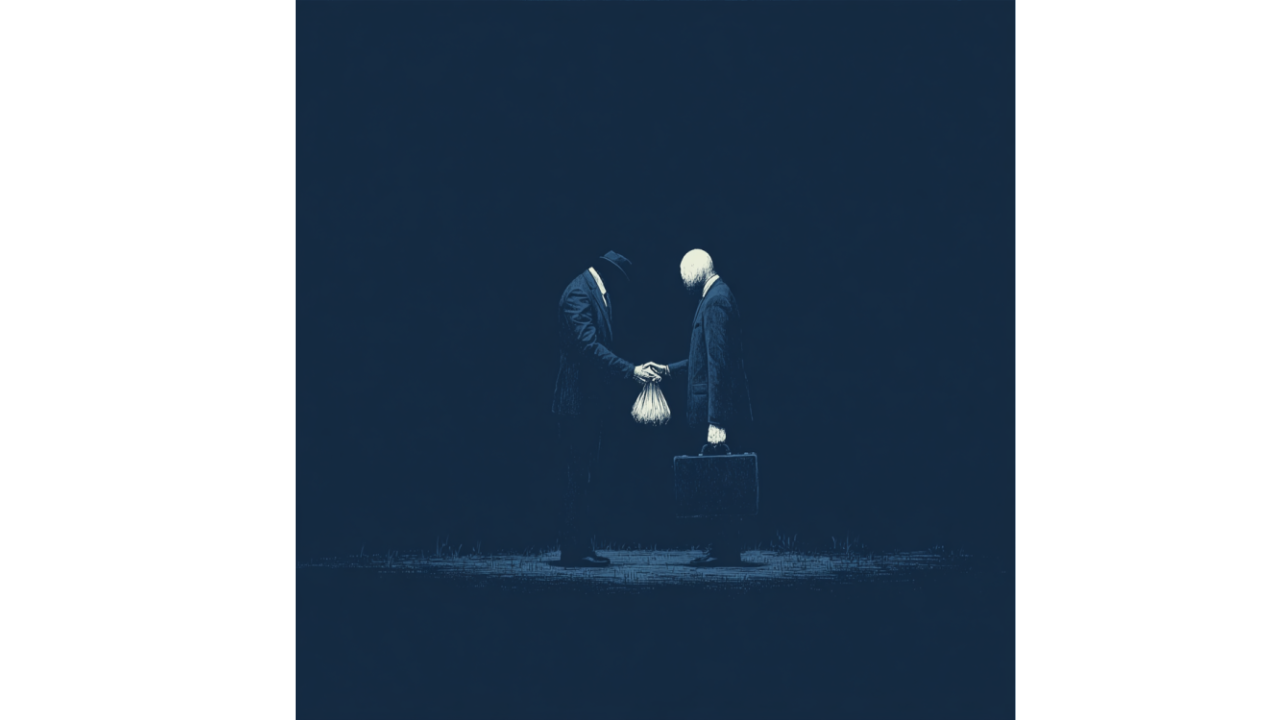

Elon Musk doesn't make small moves—he makes seismic ones. This week's confirmation of Tesla's $16.5 billion chip manufacturing deal with Samsung Electronics through 2033 isn't just a supply chain agreement; it's a masterclass in strategic positioning that could reshape the entire semiconductor power structure. While markets celebrated with Samsung shares jumping 6.8% and Tesla rising 2.7%, the real story lies in what this partnership reveals about the future of AI, autonomous driving, and global tech dominance.

We're witnessing chess moves that will determine who controls the next decade of innovation.

The semiconductor industry is experiencing an unprecedented transformation. TSMC's net revenue rose 33.9% to NT$2.9 trillion ($87.8 billion) last year, driven primarily by AI chip demand, while maintaining a dominant 67.6% market share in Q1 2025. Samsung, meanwhile, has struggled in the foundry space, holding just 13% market share compared to TSMC's 62% in Q1 2024.

But here's where it gets interesting: Samsung's foundry division has posted losses of more than $3.63 billion in the first half of this year, making the Tesla contract not just valuable—it's existential. Bloomberg Intelligence estimates the deal could boost Samsung's foundry sales by 10% annually over the contract period.

The global AI in fashion market alone is projected to reach $60.57 billion by 2034, growing at a 39.12% CAGR, while McKinsey data shows up to 25% of AI's potential in fashion will come from the creative side. Tesla is positioning itself at the center of multiple AI revolutions simultaneously.

This partnership isn't happening in a vacuum—it's unfolding against the backdrop of America's $52.7 billion CHIPS Act and escalating tensions with China. President Trump announced his intention to impose a 25% tariff on U.S. semiconductor imports on February 13, 2025, making domestic production more critical than ever.

Samsung's $37 billion Texas fab, originally delayed due to lack of customers, suddenly has purpose. The Taylor, Texas facility is scheduled to begin operations in the second half of 2026, and Musk has committed to personally walking the production line to optimize efficiency. The strategic timing couldn't be better—South Korea is currently in trade negotiations with the United States, seeking to avoid or reduce potential 25% U.S. tariffs on exports.

Meanwhile, TSMC continues to dominate with 90% of the world's advanced chips manufacturing, but geopolitical risks around Taiwan are mounting. Taiwan faces 32% tariffs announced in April and is in the midst of trade talks with the U.S., making supply chain diversification not just smart—it's essential.

The deal structure reveals Tesla's sophisticated supply chain strategy. Samsung currently manufactures the AI4 chip, while TSMC will produce the AI5 initially in Taiwan and then in Arizona. The new partnership will focus on the AI6 chip at Samsung's Texas facility, creating a three-generation, multi-vendor production pipeline that minimizes risk while maximizing innovation velocity.

This isn't just about cost savings—it's about control. Tesla's decision to partner with Samsung represents a calculated departure from its historical reliance on TSMC, driven by both supply chain resilience and the opportunity to co-develop manufacturing processes. As Musk noted, "Samsung agreed to allow Tesla to assist in maximizing manufacturing efficiency. This is a critical point, as I will walk the line personally to accelerate the pace of progress."

Samsung's breakthrough in 2nm GAA (gate-all-around) process technology, now achieving yield rates above 40%, positions it as a credible alternative to TSMC's dominance. The technology enables significantly higher energy efficiency and computational power, reducing the cost per gigaflop for autonomous driving systems.

But here's the kicker: Musk wrote on X that "The $16.5B number is just the bare minimum. Actual output is likely to be several times higher." This suggests Tesla anticipates massive scaling of its Full Self-Driving capabilities and potentially its humanoid robot Optimus program.

The competitive implications are staggering. TSMC chairman C.C. Wei stated bluntly that TSMC has no competitors, as nearly all global AI chip customers are under its control. Tesla's Samsung partnership directly challenges this assertion, potentially opening the floodgates for other major tech companies to diversify away from TSMC dependence.

This deal represents more than bilateral cooperation—it's a realignment of global semiconductor power. The partnership could accelerate the U.S. transition away from Taiwan-centric chip production while strengthening South Korea's position as a technology ally. From a national defense standpoint, convincing TSMC and Samsung to build fabs in the US is a massive national strategic win.

The timing coincides with broader industry shifts. Fashion leaders polled in McKinsey's annual survey were pessimistic, with just 20% expecting improvements in consumer sentiment in 2025, while 39% see industry conditions worsening. In contrast, Tesla's bet on AI and autonomous driving positions it for growth in markets where traditional industries struggle.

The employment implications are significant. TSMC's three Arizona fabs are expected to create roughly 6,000 direct high-tech, high-wage jobs and more than 20,000 unique construction jobs. Samsung's Texas expansion will generate similar economic benefits, creating a semiconductor manufacturing hub that reduces U.S. dependence on Asian production.

What makes this partnership revolutionary isn't just the scale—it's the precedent. Tesla is demonstrating that even TSMC's seemingly unassailable position can be challenged through strategic partnerships and long-term thinking. Samsung Foundry has seen a QoQ decline, with its share dropping to 7.7%, but the Tesla contract provides the anchor customer needed to rebuild credibility and attract other major clients.

The broader implications extend beyond semiconductors. We're witnessing the formation of a new technology alliance that could influence everything from trade policy to military strategy. Tesla's willingness to bet $16.5 billion on Samsung's foundry capabilities sends a signal to other tech giants that alternatives to TSMC exist—if you're willing to invest in the relationship.

The deal also highlights how quickly the semiconductor landscape can shift. Samsung had been struggling with "no customers" for its Texas fab as recently as last month, yet one strategic partnership transforms the entire project's viability.

For marketers and growth leaders watching these moves, the lesson is clear: in an AI-driven economy, supply chain control equals competitive advantage. Tesla isn't just buying chips—it's buying the future of autonomous systems, humanoid robotics, and whatever Musk dreams up next.

The $16.5 billion question isn't whether this deal will pay off—it's whether other companies will move fast enough to secure their own piece of the post-TSMC world.

Ready to navigate the intersection of AI and supply chain strategy? Our growth experts help companies position themselves for the next wave of technological disruption. Because in the race for AI dominance, your manufacturing partnerships matter as much as your algorithms.

There's something unsettling about watching Elon Musk turn vehicles into extensions of his personal tech empire. Tesla's rollout of Grok AI...

When the world's most important semiconductor equipment maker drops $1.5 billion on an AI startup that's worth less than OpenAI's quarterly coffee...

-1.png)

We've arrived at the moment every dystopian sci-fi writer has been waiting for: Goldman Sachs just hired its first non-human employee. Not a...