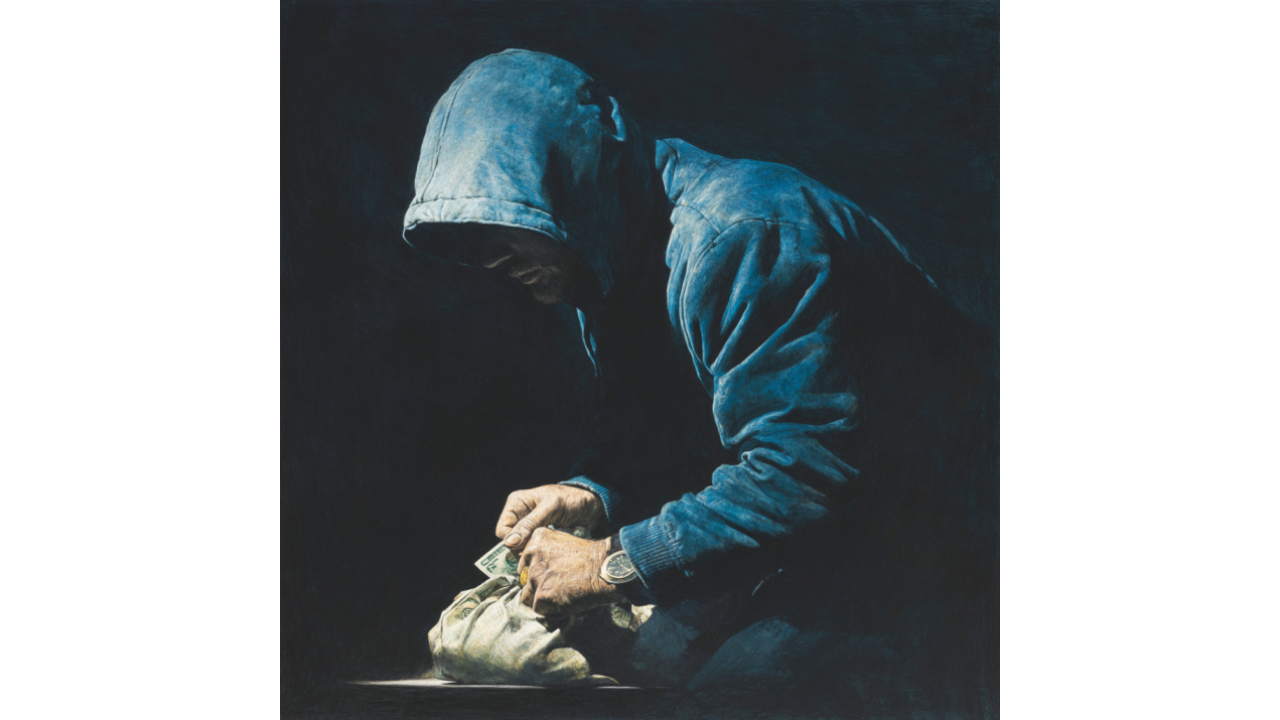

xAI's $1 Billion Monthly Burn Rate Is Everything Wrong with AI Today

Somewhere in Silicon Valley, a cash bonfire is burning through $1 billion every month, and we're supposed to call it innovation. Elon Musk's xAI, the...

3 min read

Writing Team

:

Nov 25, 2025 7:00:00 AM

Writing Team

:

Nov 25, 2025 7:00:00 AM

Elon Musk's xAI wants $15 billion. The asking price? A $230 billion valuation.

That's double the $113 billion valuation from March—eight months ago—following xAI's merger with X. The Wall Street Journal reports advanced talks with investors. Musk's financial adviser Jared Birchall circulated terms Tuesday evening. Nobody's clarifying whether that $230 billion figure applies pre-money or post-money, which matters when you're discussing numbers that could buy Boeing twice over.

For context: xAI launched in July 2023. Sixteen months later, it's apparently worth more than Goldman Sachs, Morgan Stanley, or Ford. The company's primary product is Grok, a chatbot with attitude that most people outside the X ecosystem have never used.

xAI raised $10 billion in June—$5 billion equity, $5 billion debt—to build a data center in Memphis. SpaceX kicked in $2 billion, because why wouldn't Musk's rocket company fund his AI venture? The companies are basically financial Matryoshka dolls at this point.

That $10 billion is presumably gone or committed, hence the new $15 billion raise six months later. Which means xAI is burning roughly $1.5-2 billion monthly on infrastructure buildout. That's serious capital consumption even by AI industry standards where nobody blinks at nine-figure quarterly losses anymore.

The Memphis data center represents xAI's bet on computational scale. More GPUs, more training capacity, more inference throughput. The same strategy every frontier AI lab is pursuing, just with Musk's characteristic disregard for conventional funding timelines.

Let's try to construct the bull case. xAI has direct integration with X, giving it distribution to hundreds of millions of users. It has Musk's brand, which—love him or hate him—moves markets and attracts attention. It has access to X's data firehose for training, providing unique dataset advantages.

The company's building frontier models that compete with OpenAI, Anthropic, and Google. Grok-3 is reportedly in training. The Memphis supercomputer represents serious technical infrastructure. And Musk's track record with Tesla and SpaceX demonstrates he can scale companies to enormous valuations.

That's the pitch. Now let's examine what's actually happening.

A $230 billion valuation requires believing xAI will eventually generate profits justifying that number. Let's be generous and assume a 20x price-to-earnings ratio—reasonable for mature tech companies. That means xAI needs to reach $11.5 billion in annual profit.

OpenAI, the clear market leader, is reportedly targeting $5 billion in revenue for 2024 with unclear profitability. Anthropic's revenue is smaller. Google's Gemini and Microsoft's Copilot are subsidized by massive parent companies. The entire AI industry is losing money while racing to build increasingly expensive models.

Where's the path to $11.5 billion in profit? Enterprise SaaS contracts? Consumer subscriptions? Advertising? All of those markets have established leaders with better products and stronger distribution.

Here's what's actually being valued: Musk's ability to raise unlimited capital at increasing valuations regardless of fundamentals. Tesla trades at multiples that make traditional automakers look like value investments. SpaceX commands a $350 billion valuation despite limited revenue compared to aerospace giants.

Musk has discovered that belief is more fundable than results. Promise ambitious futures, generate headlines, raise capital, and repeat. It works until it doesn't. Tesla's stock trades on robotaxi dreams, not vehicle margins. SpaceX valuation assumes Mars colonization, not just satellite launches.

xAI follows the same playbook. The valuation isn't based on current product-market fit. It's based on the idea that Musk might build something valuable eventually, plus FOMO that you'll miss the next Tesla if you don't invest now.

Does xAI have interesting technology? Probably. Musk attracts top talent and funds ambitious projects. Could Grok become a meaningful OpenAI competitor? Possibly, given enough capital and time.

But $230 billion today for a company burning billions quarterly with minimal revenue represents pure speculation. It's not investing in a business. It's buying lottery tickets priced as winning numbers.

The AI bubble inflates because investors would rather lose money being wrong together than miss returns being cautious alone. xAI's valuation reflects that dynamic perfectly. Nobody actually believes the fundamentals justify $230 billion. They believe someone else will pay $250 billion next round.

Maybe Musk builds another generational company. Maybe xAI becomes the AI leader everyone's betting on. Maybe the Memphis supercomputer trains models that reshape computing.

Or maybe we're watching another financing spectacle where valuations divorced from reality eventually collide with mathematics. The question isn't whether xAI has potential. It's whether that potential justifies prices that assume guaranteed success.

Place your bets accordingly. Just remember: when valuations double in eight months without corresponding product breakthroughs, you're investing in narrative, not numbers.

Need strategies grounded in actual metrics instead of market sentiment? Winsome Marketing focuses on measurable growth, not hype cycles. Let's talk: winsomemarketing.com

-2.png)

Somewhere in Silicon Valley, a cash bonfire is burning through $1 billion every month, and we're supposed to call it innovation. Elon Musk's xAI, the...

When we heard Elon Musk would lead a government efficiency office, we expected typical billionaire cosplay—spreadsheets, PowerPoints, maybe a few...

Bill Gates told Satya Nadella not to do it. Don't burn billions on OpenAI, he said. Nadella did it anyway. Now OpenAI is reportedly hemorrhaging $15...