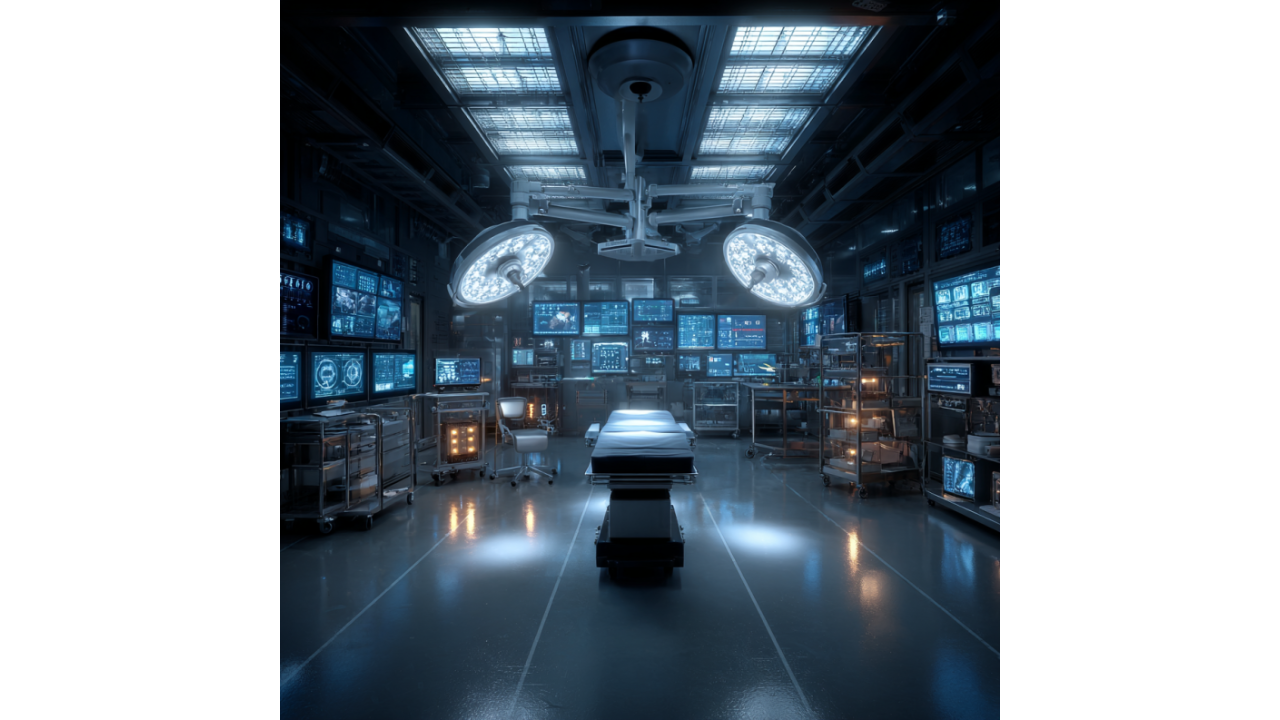

AI Enters Operating Rooms (New Startup)

Akara, a startup building "air traffic control for hospitals," landed on Time's Best Inventions of 2025 list by tackling a problem nobody's hyping...

5 min read

Writing Team

:

Oct 3, 2025 8:00:00 AM

Writing Team

:

Oct 3, 2025 8:00:00 AM

Peloton just raised membership fees by 11-14% across all tiers while hemorrhaging subscribers, posting a $118.9 million annual loss, and watching its stock trade at $8.17—down from a 2021 peak of $170. Their solution? Slap "AI-powered" on the product page and charge even more.

This isn't innovation. It's the corporate equivalent of rearranging deck chairs on the Titanic while insisting the iceberg is actually a premium ice sculpture experience.

Let's start with what Peloton isn't emphasizing in their press releases. Paid subscribers dropped from nearly 3 million to 2.8 million year-over-year. That's a 6.7% decline in the metric that actually matters for a subscription business. Revenue hit $2.5 billion, but they still lost $118.9 million—an improvement over the previous year's $551.9 million loss, but only because they've been slashing costs and cutting 6% of their workforce.

Their response to declining subscribers and continued losses? Raise prices dramatically:

This is the pricing strategy of a company that's given up on growth and decided to extract maximum revenue from a shrinking customer base. It's the Netflix password-sharing crackdown playbook, except Peloton doesn't have Netflix's content library or market position to make it work.

Peloton's big innovation is "Peloton IQ," described as "an AI-powered platform that gives members personalized workout guidance." CEO Peter Stern promises "a new level of intelligent personalization to become the ultimate partner in our members' wellness journeys."

Strip away the corporate speak, and you're left with questions nobody's answering: What does this AI actually do that rule-based recommendation systems couldn't accomplish five years ago? Is it analyzing form in real-time? Adjusting workout difficulty based on biometric feedback? Generating custom training plans based on performance history?

Or is it just collaborative filtering—the same algorithm Netflix uses to suggest shows—wrapped in "AI" branding because every struggling tech company in 2025 thinks slapping "AI-powered" on their product will reverse their fortunes?

The press release is deliberately vague. "Intelligent personalization" could mean anything from sophisticated machine learning models analyzing dozens of performance variables to a basic if-then statement that suggests harder classes when you complete easier ones consistently. Given that Peloton is simultaneously raising prices while losing subscribers and posting losses, I'm betting on the latter disguised as the former.

Peloton is also introducing swivel screens on their equipment to "let users toggle between cardio, strength training, yoga and meditation workouts." This is being marketed as "doubling the value of hardware by delivering world-class cardio and strength in a single machine."

A swivel screen doesn't double the value of anything. It's a $50 hardware modification that lets you watch different videos on the same screen. Peloton already offered strength, yoga, and meditation classes through their app—you just had to move to a different part of your home to do them. Now you can stay near your bike while doing a yoga class. That's convenience, not transformation.

This is the fitness equipment equivalent of a restaurant adding "artisanal" to the menu description and raising prices 20%. The product didn't fundamentally change—the marketing did.

Peloton's core issue isn't that their product lacks AI features. It's that they built a business model dependent on pandemic conditions continuing indefinitely. When people were locked in their homes, a $2,000 exercise bike with live-streamed classes seemed reasonable. When gyms reopened and people remembered that working out in public doesn't require a subscription fee, the value proposition collapsed.

No amount of AI personalization fixes this. The problem isn't that Peloton's workout recommendations aren't smart enough—it's that a growing number of people don't want to pay $50 monthly plus $1,700 upfront for the privilege of exercising at home when a $50 annual Planet Fitness membership exists.

A 2024 IHRSA study found that gym memberships rebounded to 86% of pre-pandemic levels, with budget gyms seeing the strongest growth. Meanwhile, connected fitness equipment sales dropped 34% year-over-year in 2024, according to NPD Group data. The market is telling Peloton their product category is contracting, and they're responding by raising prices and adding features that don't address the fundamental value proposition problem.

Peloton joins a growing list of struggling tech companies trying to AI their way out of business model problems. It's the 2025 equivalent of adding "blockchain" to your company description in 2017 or pivoting to "the metaverse" in 2021. When you don't have a growth strategy, you attach yourself to whatever buzzword investors are currently excited about.

The tell is in the timing. If AI personalization was genuinely valuable, why announce it alongside double-digit price increases while losing subscribers? Because this isn't about improving the product—it's about justifying price hikes to Wall Street analysts who need some narrative to explain why paying more for a declining service makes sense.

Compare this to companies where AI integration actually transformed the user experience. When Spotify introduced AI-powered Discovery Weekly in 2015, it was free to existing subscribers and demonstrably improved music discovery. When Adobe integrated AI into Photoshop, it made professional-level editing accessible to casual users. These were value additions, not price justification mechanisms.

Peloton's AI launch feels like the latter. They're not leading with what the AI enables that was previously impossible—they're leading with price increases and describing AI as the reason you should pay more.

Here's the cruelest part: Peloton's existing subscribers are about to pay 13-23% more for service they've already demonstrated they value. These aren't new customers who signed up knowing the AI-enhanced prices—these are loyal users who bought during the pandemic and stuck around through the company's struggles.

Their reward for loyalty? Forced upgrades to more expensive membership tiers with features they didn't request. The email announcing the price increase presumably frames this as exciting new value, but the reality is simpler: Peloton needs more revenue per subscriber to make their business model work, and they're betting that sunk costs (you already own a $2,000 bike) and switching costs (finding alternative live fitness classes) will keep people paying despite the increase.

Some will cancel. Most will probably stay, grumble, and pay more. That's the calculus Peloton is making. It's the same calculus every subscription service makes when growth stalls—extract more from existing customers because acquiring new ones is too expensive.

A 2024 Recurly study found that price increase acceptance rates hover around 70-75% for established subscription services, meaning 25-30% of customers cancel when prices rise. Peloton can afford to lose a quarter of their remaining 2.8 million subscribers if the rest pay 13-23% more. The math works, even if the customer experience doesn't.

The central question nobody's asking: Does Peloton IQ make anyone healthier, stronger, or more consistent with their fitness routine? Or does it make Peloton's financial projections look slightly less catastrophic?

Personalized fitness recommendations already exist in dozens of free and low-cost apps. Strava uses AI to analyze your running patterns. MyFitnessPal uses it for nutrition tracking. Apple Fitness+ adjusts recommendations based on your workout history. The AI-powered fitness recommendation space is crowded, competitive, and mostly free.

What Peloton is offering isn't unique capability—it's the same capability bundled with $1,700 hardware and a $50 monthly fee. That's not innovation. That's hoping customers don't notice that better alternatives exist without the price tag.

Tired of vendors using "AI-powered" to justify price increases for features that don't actually improve outcomes? Winsome Marketing's growth experts help marketing leaders evaluate whether AI features deliver real value or just expensive rebranding. Let's talk about separating genuine innovation from desperation plays.

Akara, a startup building "air traffic control for hospitals," landed on Time's Best Inventions of 2025 list by tackling a problem nobody's hyping...

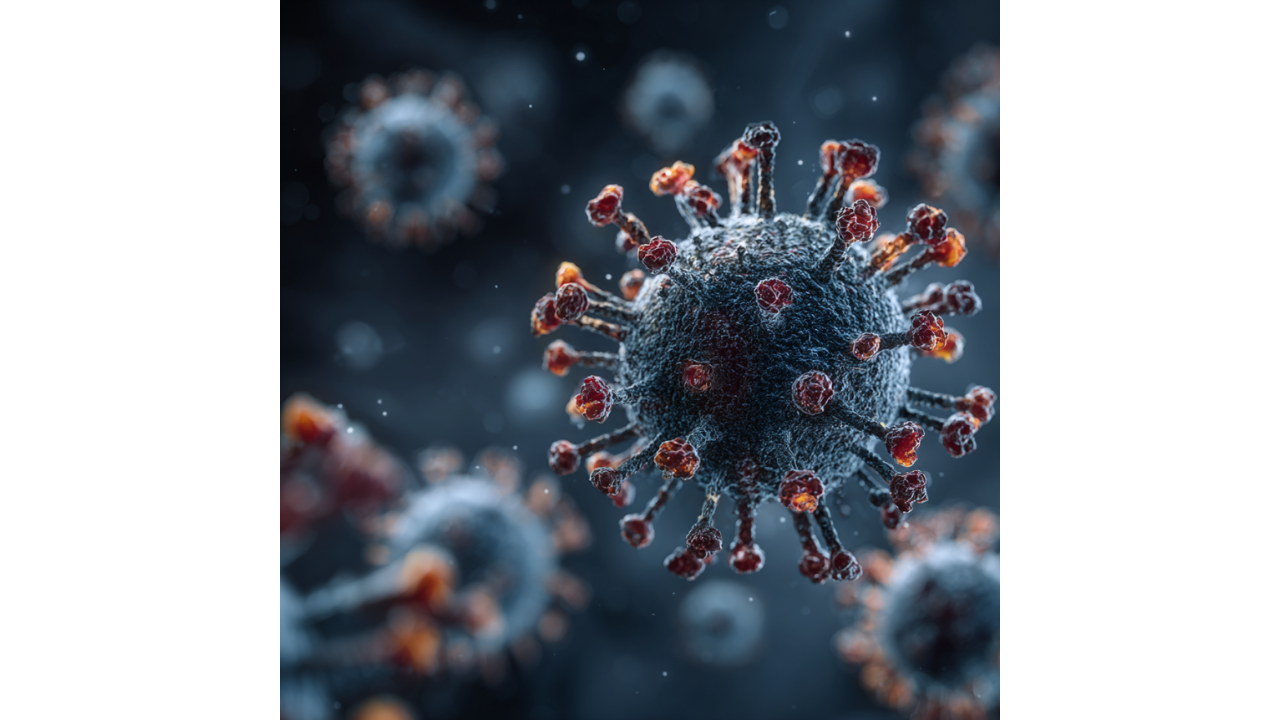

Scientists have crossed a threshold that demands our attention: for the first time, artificial intelligence has successfully designed viruses capable...

The U.S. Department of Health and Human Services just announced a $2 million prize for AI tools that will help caregivers manage the crushing burden...